When Markets Go Autonomous: How AI-Run Economies Are Quietly Becoming Real

What if the next central banker is a neural net? What if the hottest VC round isn’t for a human startup, but for a hive of AI agents that negotiate, trade, and allocate capital with zero human touch? Sounds like sci-fi? It’s not. It’s already happening:and the financial world hasn’t even blinked.

From Web3 games to DAOs and simulated nation-states, autonomous AI agents are beginning to run economic systems. Not in theory; in code, on-chain, and in production.

Games Are the New Labs

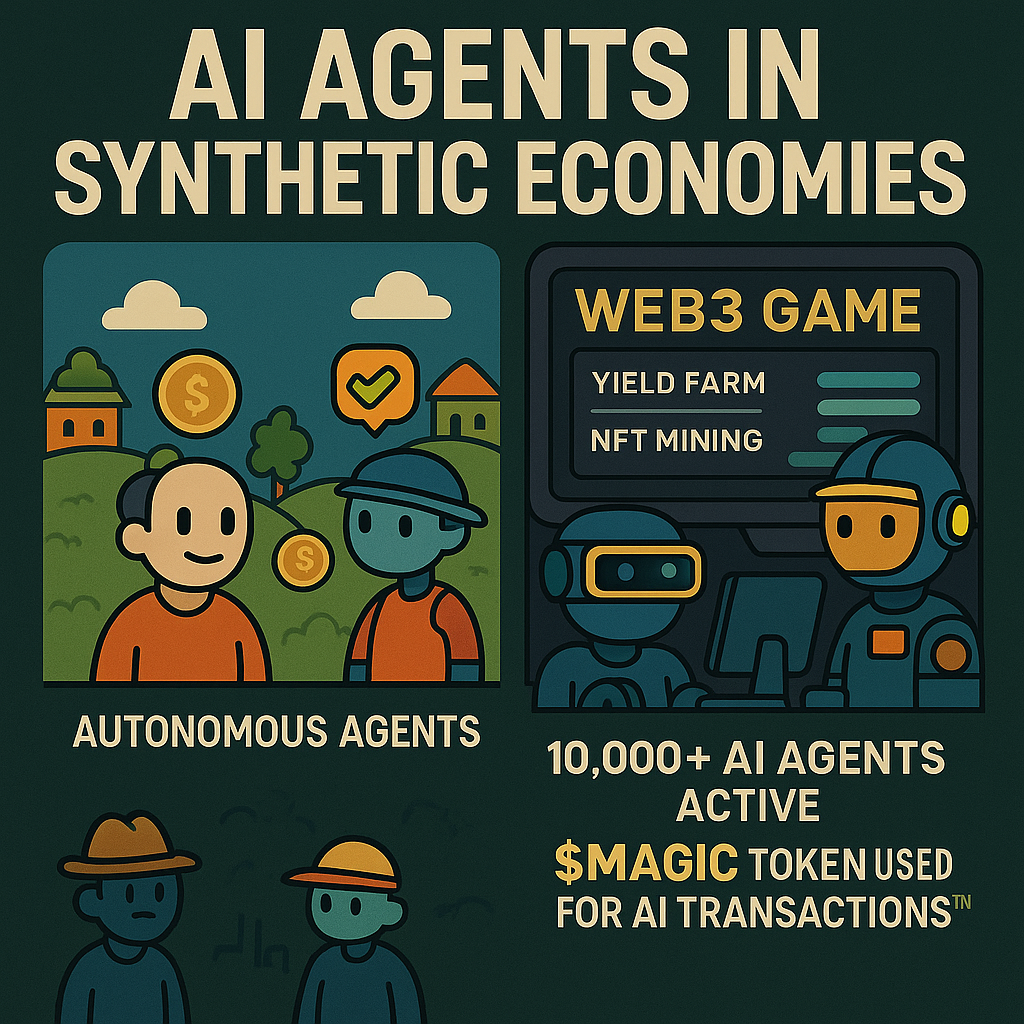

Let’s talk gaming first. Not your brother’s Xbox, but full-on crypto metaverses where AI agents own wallets, earn tokens, and influence digital markets. On Arbitrum’s Smolverse, thousands of AI-controlled NFTs (“Smols”) are no longer just collectibles. They act, live, and transact. The next rollout will let them build societies and trade $MAGIC tokens:all autonomously. No player input needed.

Across TON’s hypercasual games, AI pets don’t just wag tails: they mine, trade, and earn assets. These are not NPCs; they’re autonomous economic agents driving token flows. Game devs are calling them “Tamagotchis with wallets.”

Why this matters? These sandbox economies are training grounds. AIs learning to optimize yields, barter, and govern resources in games could soon deploy the same logic in real-world finance. And users are watching: there are over 10,000 AI agents operating in Web3 already.

DAOs Are Hiring Machines

In the world of decentralized governance, AI is no longer a back-office assistant. It’s a stakeholder.

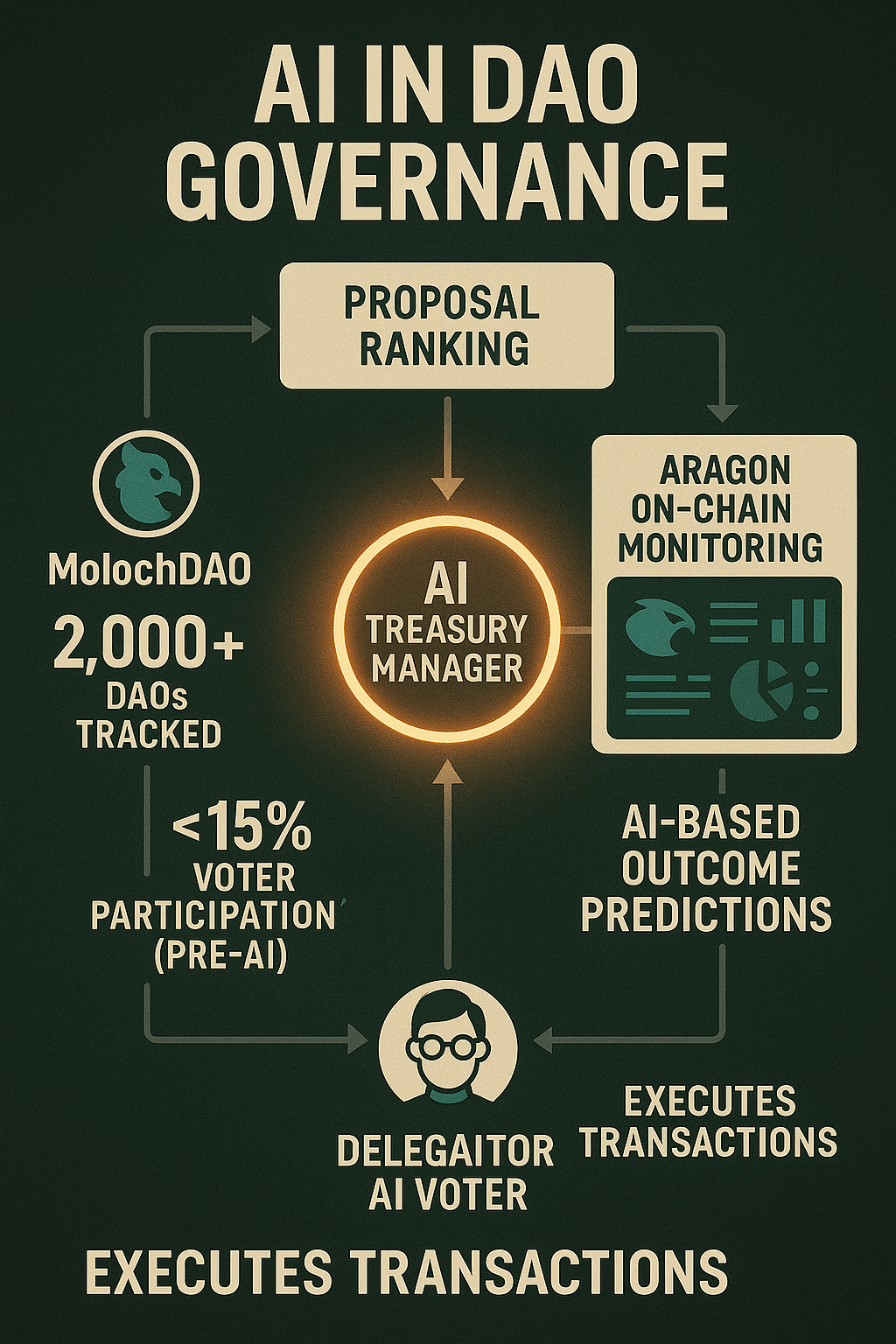

MolochDAO now uses AI to rank grant proposals by outcome likelihood. Aragon’s platform monitors 2,000+ DAOs to flag underfunded high-potential projects. The result? Faster, smarter decisions without relying on voter apathy or emotion.

MakerDAO is going even further. Its “Endgame” roadmap includes AI-generated proposals and self-adjusting monetary models. Other DAOs are deploying AI agents to reallocate treasuries in real time. Forget quarterly board meetings: AI sees the data and pulls the trigger in milliseconds.

Personal AI voters? Already here. Tools like Delegaitor let you train an AI to vote your tokens based on your values. No more Discord threads. No more decision fatigue. Just outcome-based governance.

Banks Build Twins. AI Watches Everything.

While DAOs go agile, central banks are building shadows of the real economy: "digital twins" to simulate policy in real time.

The Bank of England has an entire team building AI-led economic stress models. JPMorgan Research co-developed ABIDES-Economist, a fully agent-based simulated economy with households, firms, and a central bank. It’s not guesswork: it’s where AI learns policy dynamics and simulates human behavior under stress.

Private firms are following suit. Platforms like Delfi let banks test interest rate risks by simulating balance sheets in real time. Instead of waiting for the next crash, AI is stress-testing portfolios daily and adjusting the hedges on autopilot.

The Rise of Autonomous Agents

Fetch.ai, BitTensor, SingularityNET: these aren’t science experiments. They’re live infrastructure projects where AI agents stake, earn, and vote using crypto tokens.

A new breed of funds is emerging. AI-managed DAOs, where agents evaluate deals, allocate capital, and execute: all with minimal human approval. The result? Hyper-efficient, continuous financial operations. Markets that never sleep, managed by machines that never blink.

The AI-Economist project by Salesforce proved this at scale: reinforcement learning agents learned to outperform traditional tax models by 16% in balancing equality and productivity. Let that sink in: AI tax policy that beats top economists.

The Funding is Real

Here’s the kicker: the funding is real. Smolworld’s economy is run on $MAGIC tokens with actual market caps. Fetch’s autonomous agents trade in open DeFi protocols. ABIDES is used by actual macro researchers.

This is not Web3 hype 2.0. It’s capital-efficient, data-driven automation. And it’s running in production, not in pitch decks.

But Let’s Be Clear

Autonomous markets are fast. They’re precise. But they’re not moral. Without safeguards, AI agents can, and will, optimize ruthlessly. That’s why regulators are stepping in. The EU already mandates “human kill switches” for AI-led DAOs. Think of it as circuit breakers, but for algorithms.

The future is synthetic economies and autonomous allocators. But the playbook is still being written.

What we’re seeing isn’t the death of human governance; it’s the rebirth of financial systems with AI as co-pilot.

Call it AI capitalism. Call it post-human finance. Just don’t call it theoretical.

Because it’s already here.