The Staking Gold Rush 2.0: Why Liquid ETH Is the New Bond Market

There was a time when staking was a niche corner of crypto, reserved for the technically inclined and liquidity-agnostic. That time is over. What used to be dismissed as an illiquid sideshow is now turning into one of the most important financial primitives in crypto. Liquid staked ETH is no longer a curiosity. It’s becoming the new benchmark for passive yield.

And it’s blowing past Treasuries.

The Death of Bonds. The Rise of ETH.

We’re in an environment where traditional fixed income is struggling to keep up with inflation. US Treasuries barely clear 4 percent, and real returns are arguably negative once you price in duration risk and currency debasement. Meanwhile, Lido, Rocket Pool, and a handful of emerging players are offering 4 to 5 percent yield on ETH, paid in kind, on an asset with asymmetric upside.

It’s not a stretch to say that liquid staking is becoming the crypto-native equivalent of sovereign bonds, except with more composability, no bank middlemen, and a far better upside profile. You don’t just earn a baseline yield for staking ETH. You unlock a toolkit.

Staked ETH That Doesn’t Sit Still

The breakthrough is simple but powerful. In the old model, staking ETH meant locking it away. That made sense when the only goal was network security. But today’s stakers want more than that. They want yield that moves. Assets that work.

Enter liquid staking derivatives like stETH (Lido) and rETH (Rocket Pool). You stake ETH and receive a token that represents your claim and accrues staking rewards! But can also be traded, borrowed against, or deployed across DeFi.

This is where it gets interesting. stETH earns yield just for existing, but it can also be looped into Curve pools, used as collateral on Aave, or deposited into EigenLayer restaking contracts. Each move layers more potential yield on top of a fundamentally stable base.

The result is a hybrid income asset: it behaves like a yield-bearing bond, but you can swap it, borrow against it, or use it to farm additional rewards.

Liquid Staking Is Eating Bonds for Breakfast

Forget 10-year Treasuries. In 2025, the real yield lives on-chain, wrapped in tokens like stETH and rETH. Liquid staking is turning Ethereum into a global bond desk, except this time, you don’t have to lock your capital with a central bank praying inflation stays tame.

You stake your ETH, get a derivative like stETH (Lido, ~4.5% APY), rETH (Rocket Pool, ~4.3%), or cbETH (Coinbase, ~3.8% post-fee), and that token starts working immediately.

Not only does it accrue staking rewards, it can be traded, posted as collateral, looped into lending platforms, or even restaked for extra juice via EigenLayer.

Lido dominates the liquidity game, but Rocket Pool wins on decentralization. Coinbase? Great for institutions, less for DeFi cowboys. Frax’s frxETH pushes the curve with dual-token mechanics and up to 5% APY, while StakeWise offers composable ETH exposure with split-token flexibility.

In TradFi terms, liquid staking is a bond that pays yield, trades 24/7, and can be rehypothecated with leverage minus the JPM middlemen. And that’s exactly why capital is rotating here.

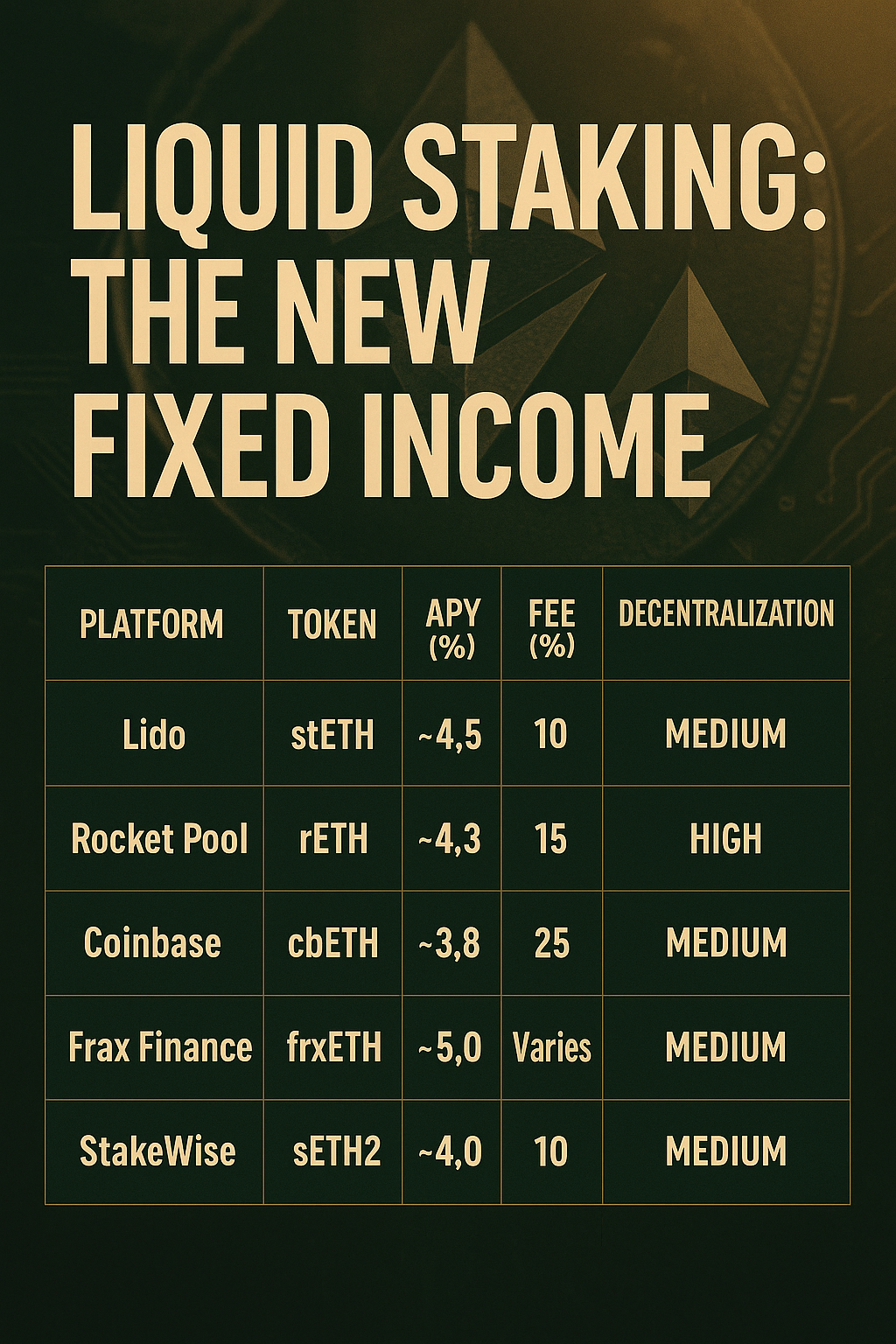

Comparative view of Major Liquid Staking Platforms

| Platform | Token | APY (%) | Fee (%) | Decentralization | DeFi Integration | Notes |

|---|---|---|---|---|---|---|

| Lido | stETH | ~4.5 | 10 | Medium | High | Largest market share |

| Rocket Pool | rETH | ~4.3 | 15 | High | Medium | Community-driven |

| Coinbase | cbETH | ~3.8 | 25 | Low | Low | Centralized exchange |

| Frax Finance | frxETH | ~5.0 | Varies | Medium | Medium | Dual-token system |

| StakeWise | sETH2 | ~4.0 | 10 | Medium | Medium | Dual-token system |

Institutional Attention Is Brewing

Smart institutions are noticing. With ETH’s transition to Proof-of-Stake completed and withdrawal mechanisms fully enabled, liquid staking is starting to behave like a proper fixed-income market, except with on-chain transparency and 24/7 liquidity.

Lido now secures over 30 percent of all staked ETH. Rocket Pool is growing fast. Even Coinbase has jumped in with cbETH, targeting users who want exposure without touching DeFi directly.

This is not a speculative yield farm. This is the foundation of a new capital market.

The Real Risk Isn't Staking. It's Sitting on Fiat.

There are risks, of course. ETH price volatility. Smart contract risk. Temporary depegs. But these are manageable... especially when the alternative is locking capital in fixed-income instruments that are eroded by inflation and capped by central banks that are out of bullets.

For years, the financial world has chased yield in the shadows. CLOs, negative-rate bonds, DeFi rugs, you name it. Liquid staking flips the model. You get transparent, provable, sustainable yield on the most important asset in decentralized finance and without giving up control.

This isn’t the new carry trade. It’s the new anchor.

While TradFi waits for Powell to pivot, crypto is already stacking 5 percent yields with upside. Your bonds are stale. Your ETH is liquid and paying rent.