Predicting Price With On-Chain AI is Crypto's Best Signal

Welcome to the edge.

While crypto Twitter screams about ETFs, meme coins, and layer 2s that launch with negative fees, the actual alpha is being built where few are looking: on-chain machine learning models that digest real blockchain activity and forecast what happens next.

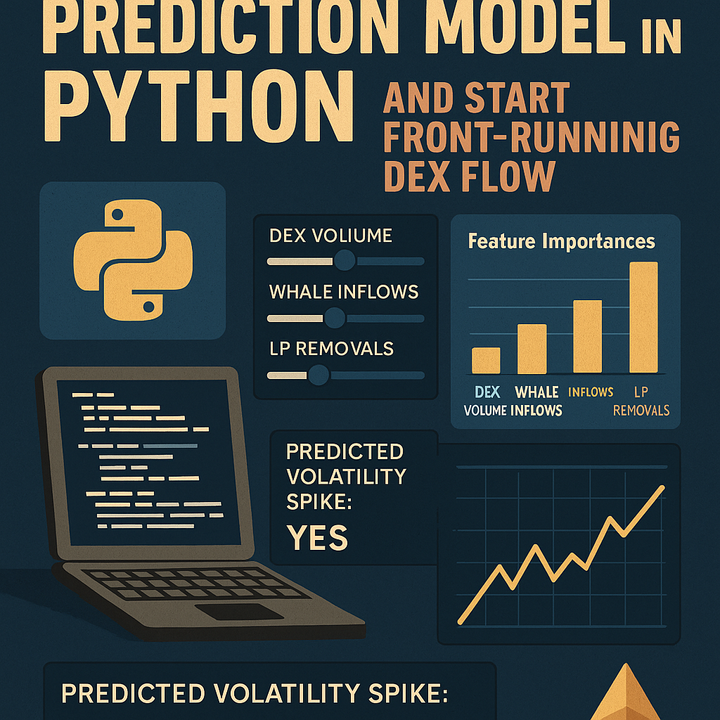

Not vibes. Not speculation. We're talking about neural nets trained on raw DEX flows, liquidity shifts, whale wallets, and mempool queues. These models are predicting volatility spikes, price jumps, and liquidity runs before they happen.

What Even Is On-Chain ML?

Before we dive in, let’s break the jargon.

On-Chain ML means training machine learning models, like neural nets or transformers, on data directly from the blockchain. This includes:

- DEX trade flows (what’s actually being swapped in real-time)

- Liquidity movements (are whales pulling liquidity from Uniswap? Are new LPs piling in?)

- Wallet flows (are “smart money” addresses suddenly buying?)

- Mempool data (pending transactions that haven’t even been mined yet)

Traditional quant models look at price, volume, maybe sentiment. On-chain ML looks at the actual cash flows before they impact price.

If crypto is a living organism, on-chain data is the bloodstream. ML models are the stethoscope.

Why This Works: You Can’t Fake On-Chain Flow

Forget price charts. On-chain is truth.

Every DEX swap, every LP (Liquidity Provider) removal, every token bridging event it's timestamped, signed, and publicly accessible.

- A whale dumps $3M of ETH into USDC on Uniswap? It's on-chain.

- 100 new wallets start buying the same token at once? On-chain.

- Liquidity vanishes from a Curve pool before a peg break? On-chain.

Now imagine training a model to watch this data 24/7. It starts to learn that when “Wallet A” moves funds to Binance, BTC usually drops 0.8%. Or when 10+ LPs exit a pool within 15 minutes, volatility spikes 90 minutes later.

This isn't “magic quant” stuff. It's observable, repeatable behavior and machine learning eats that for breakfast.

The Model Arsenal: From Graphs to Transformers

Let’s break down the weapons being used.

1. Time Series Models (LSTM / Transformers)

Think of these as models that look at sequences. They learn from patterns over time.

Example: Feed in 15-minute windows of DEX trades, price, volume, liquidity shifts: model predicts the next move.

Used by:

- ETHGlobal hackathon teams: +30% backtested return on memecoin sets

- Research groups forecasting BTC volatility spikes (daily returns >2σ)

Models: LSTM, GRU, and increasingly, Transformers (like what powers ChatGPT, but lighter)

Transformers are monsters at handling multi-dimensional time series: price, exchange flows, stablecoin supply, even social sentiment. In 2024, a paper showed that a transformer trained on exchange inflows, miner outflows, and whale alerts beat every traditional model for forecasting BTC volatility spikes.

But transformers are heavy. Most live off-chain but that’s changing (we’ll get to on-chain inference soon).

2. Graph Neural Networks (GNNs)

Most powerful, least understood.

GNNs turn the blockchain into a graph: wallets are nodes, transactions are edges. Then they learn patterns in how wallets interact.

Imagine this:

- A cluster of 20 wallets always buys the same coins before they pump.

- A whale wallet is the hub of 100 low-cap LPs.

- A protocol suddenly starts being used by all “smart money” wallets.

GNNs catch these structural behaviors that time-series models miss.

Example: Pond is building a foundation model trained on the entire transaction graph. Think of it as a large language model, but for wallet behavior.

Use cases:

- Spotting coordinated buy-ins before price breaks

- Flagging early DeFi exit signals

- Even powering personalized AI recommendations (e.g., which DAOs a user might vibe with)

Drawback: GNNs are heavy. Most training happens off-chain. But they can output scores or signals in real-time, and protocols can use them via API or oracle.

3. Lightweight On-Chain Models (Real-Time DeFi AI)

Now we’re cooking.

These are models small enough to run inside smart contracts. Think basic neural nets or regressions.

Example: Vanna Labs’ VannaSwap

They trained a volatility model to dynamically adjust AMM trading fees on-chain. It looks at current volatility and says:

“Market is heating up? Raise fees to protect LPs.”

“Stable conditions? Lower fees to attract volume.”

The entire model is deployed on-chain using the Valence blockchain (EVM-compatible, optimized for ML).

Outcome: LPs make more during volatility. Traders get fair pricing. No humans needed.

This is the future: protocols that react intelligently, in real-time, based on on-chain conditions.

The Data That Feeds These Models

All of this is possible because crypto gives you data that Wall Street would kill for:

| Data Source | Why It Matters |

|---|---|

| DEX Swaps (e.g. Uniswap) | Shows real-time demand and price impact |

| LP Events (Adds/Removes) | Reveals market confidence and volatility expectations |

| Whale Transfers | Predicts major price moves (whales to CEX = likely sell) |

| Mempool Orders | Predicts future trades before they settle |

| Stablecoin Movements | Leading indicator of liquidity rotation |

| Exchange Reserve Flows | Shows if users are gearing up to sell (inflows) or buy (outflows) |

Combine 5–10 of these in a model, and you’ve got a radar for volatility that’s faster than Twitter.

Who's Actually Doing This?

Here’s your market map:

| Project | Model Type | Key Use Case | On-Chain? |

|---|---|---|---|

| Pond | GNN (Graph) | Predict market shifts from wallet graphs | Partial |

| VannaSwap | Linear regression | Adaptive AMM fees based on volatility | Yes |

| Ethena (USDe) | Funding rate arbitrage model | Yield generation from perp shorts | No |

| Glassnode | Tree-based ML | Long/Short signals from on-chain metrics | Off-chain |

| Inference Labs | Transformer pipeline | Alpha signals, risk management | Off-chain |

| Valence | Custom inference infra | Native on-chain ML runtime | Yes |

The Caveats (Because Nothing is Risk-Free)

Let’s be honest. ML is powerful, but it’s not bulletproof. Risks include:

- Overfitting: Your model learns past noise and fails in live trading.

- Data shifts: 2021 crypto ≠ 2025 crypto. Retraining is mandatory.

- Reflexivity: If everyone uses the same model, it stops working.

- Gas costs: On-chain inference has limits (but Layer 2s + zkML can help).

- Interpretability: Neural nets can go rogue. You need guardrails.

Still, these are solvable. With techniques like distillation (simplifying big models), zero-knowledge proofs for ML, and ensemble methods, teams are building smarter and safer.

Where This Goes Next

- DeFi protocols will become self-tuning: lending pools will raise rates during volatility automatically, AMMs will change behavior block-to-block.

- ML-powered oracles: not just price feeds, but volatility forecasts, liquidity risk, even funding rate predictions.

- Cross-chain models: aggregating flow from Ethereum, Solana, Arbitrum, and BNB in one model for true market awareness.

- Composable signals: imagine a dApp that lets you combine “Whale flow spike” + “Liquidity pull from Curve” into your own trading rule.

- Retail-friendly wrappers: like a “safety meter” in your wallet powered by on-chain ML: you know if a token is about to get rugged or pumped before you click swap.

This Is the Next Frontier of Alpha

While others chase headlines and hype coins, on-chain ML is where the smart money is building.

It’s still early. It’s still weird. But it’s working. Models are reading blockchain flows like a book and front-running the next chapter.

If you’re a trader, start learning how to use these signals.

If you’re a founder, consider integrating ML into your protocol logic.

If you’re a researcher, this is a goldmine of unsolved problems.

And if you’re doing none of that?

At least know this: the game is changing.

And the next time price moves before anyone tweets about it, it might be a model , not a human, that saw it first.