Is the AI Boom a Bubble? Or the Beginning of a Financial Supercycle?

Let’s get something straight: this isn’t your garden-variety hype cycle. What we’re witnessing right now is a full-scale capital migration: an unprecedented flow of trillions into artificial intelligence. From Wall Street to Sand Hill Road, from high school crypto traders to sovereign wealth funds, the smart money isn’t betting on apps anymore. It’s betting on AI.

So here’s the trillion-dollar question: is this the next dot-com bubble, destined to implode? Or is it the early innings of the next great supercycle, where early believers get rewarded and the latecomers buy the top?

The answer? It's complicated. But here’s what the data-and market behavior-suggest.

The Market’s AI Crown: Big Tech Rules Everything Around Me

Let’s start with the obvious. The Magnificent Seven-NVIDIA, Microsoft, Apple, Meta, Alphabet, Amazon, and Tesla-now make up nearly 35% of the S&P 500. That’s more market cap concentration than we saw at the peak of the dot-com bubble. But the difference? These companies are actually printing money.

Take NVIDIA, the face of AI infrastructure. It’s up 200%+ in 2023, and for good reason. It’s not just dominating headlines; it’s dominating earnings reports. Revenue is up 206% year over year. This isn’t a whiteboard pitch. It’s a firehose of real, verifiable growth.

Compare that to Cisco in 2000. Same parabolic chart. But Cisco was trading at 131x forward earnings-a financial mirage. NVIDIA? Closer to 40x, and with a product the world can’t get enough of.

And it’s not just NVIDIA. Microsoft, fresh off a $10 billion-plus OpenAI partnership, is already baking AI into Office and Azure. Amazon is building AI-enhanced AWS tools. Alphabet is pivoting its entire search and cloud stack around Gemini. Unlike 2000, this isn’t speculative. This is strategic.

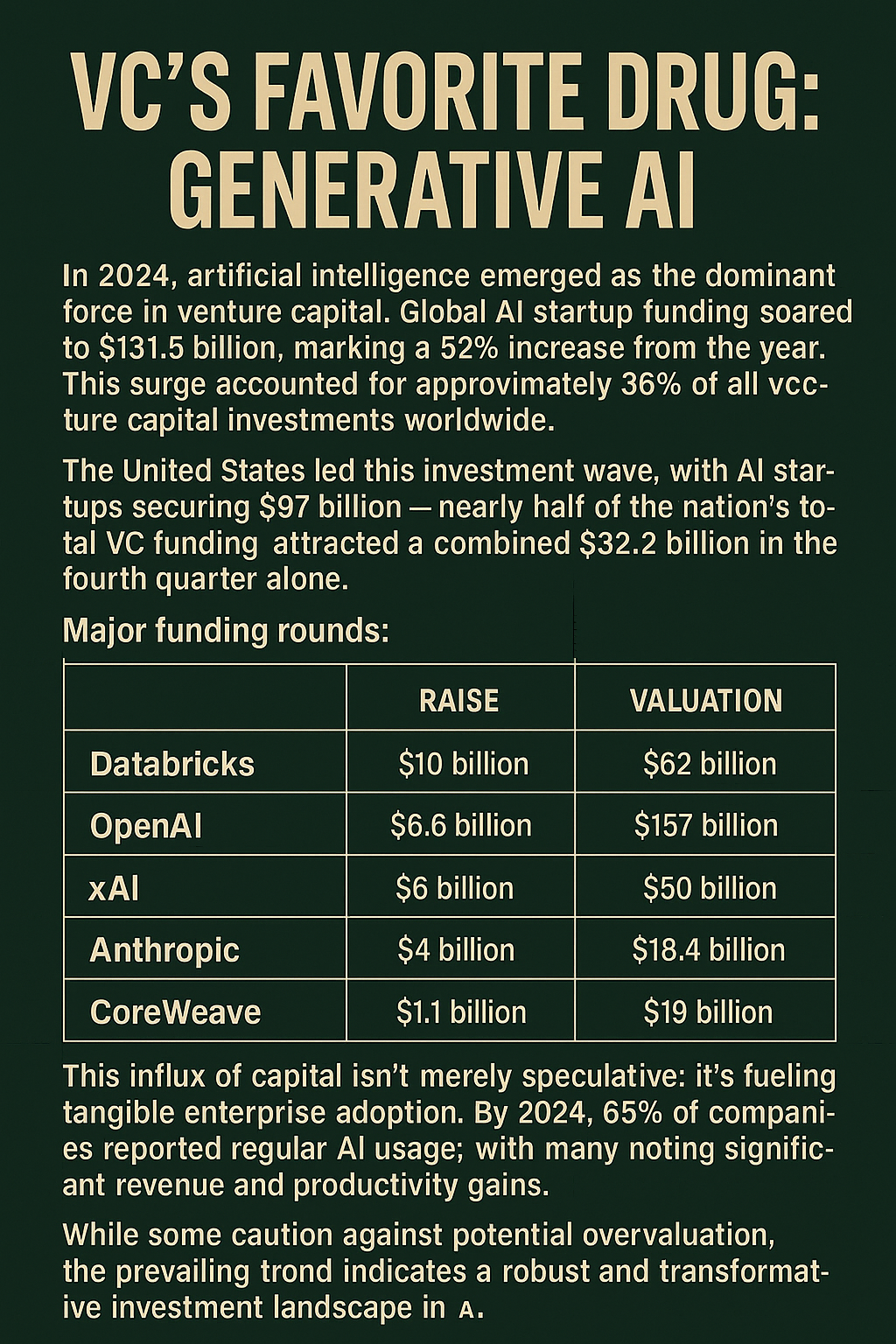

VC’s Favorite Drug: Generative AI

Now swing over to the private markets. You think crypto was hot in 2021? That was the rehearsal. In 2023, AI startups pulled in $42.5 billion across roughly 2,500 deals, accounting for 37% of total VC funding.

Startups like Anthropic, Inflection, OpenAI, xAI-each raised billions at pre-revenue stages. Databricks closed a $10 billion late-stage round. OpenAI is valued north of $80 billion. This isn’t a trickle of capital-it’s a flood.

Yes, there are bubble signs. But enterprise demand is real.

AI isn’t being funded to build toys; it’s being funded to build infrastructure. In 2024, 65% of companies reported regular AI use, and many reported real revenue and productivity gains. That’s not vaporware. That’s transformation.

The Ghost of Bubbles Past

We’ve seen this movie before: dot-com, Web3, SPACs. And AI echoes those eras.

- Investors are chasing buzzwords.

- Meme-stock-style price action is rampant.

- Valuations can stretch reality.

But there’s one crucial difference: the leaders are not fly-by-night startups. They’re capital-rich, revenue-generating institutions. Microsoft. Amazon. Google. These are AI superpowers.

And they’re delivering. Not hypotheticals. Not vapor. Tangible revenue and product distribution at scale.

That’s not to say some startups won’t crash. They will. But bubbles matter when they pop before the trend matures. AI is already integrated across industries. It’s not optional anymore.

So… Is This a Bubble?

Some of it is.

- Valuations for pre-product firms are disconnected from reality.

- Some venture rounds look like musical chairs.

But the infrastructure is real. The demand is real. And the economics-at least for top-tier players-are strong.

NVIDIA is being priced like the arms dealer of a new digital war. And it’s delivering. Microsoft, Alphabet, and Amazon aren’t dreaming about ROI; they’re already reporting it.

In the 20th century, oil powered economies. In the 21st, data and intelligence will.

The firms monetizing that shift-profitably-are worth watching.

A Final Word For Gen Z Investors

You’ve seen crypto booms. You’ve survived meme stocks. You know hype when you see it.

But this isn’t just hype. This is capital formation around what may be the most transformative technology since the internet.

Don’t go all in. Don’t ignore fundamentals. But don’t sit it out.

The AI economy may be inflated in pockets. But broadly? It looks like the beginning of a supercycle.

Be early. Be cautious. But be there.