Crypto's Institutional Tipping Point: Big Banks, Bigger Bets, and the Rise of the Digital Dollar

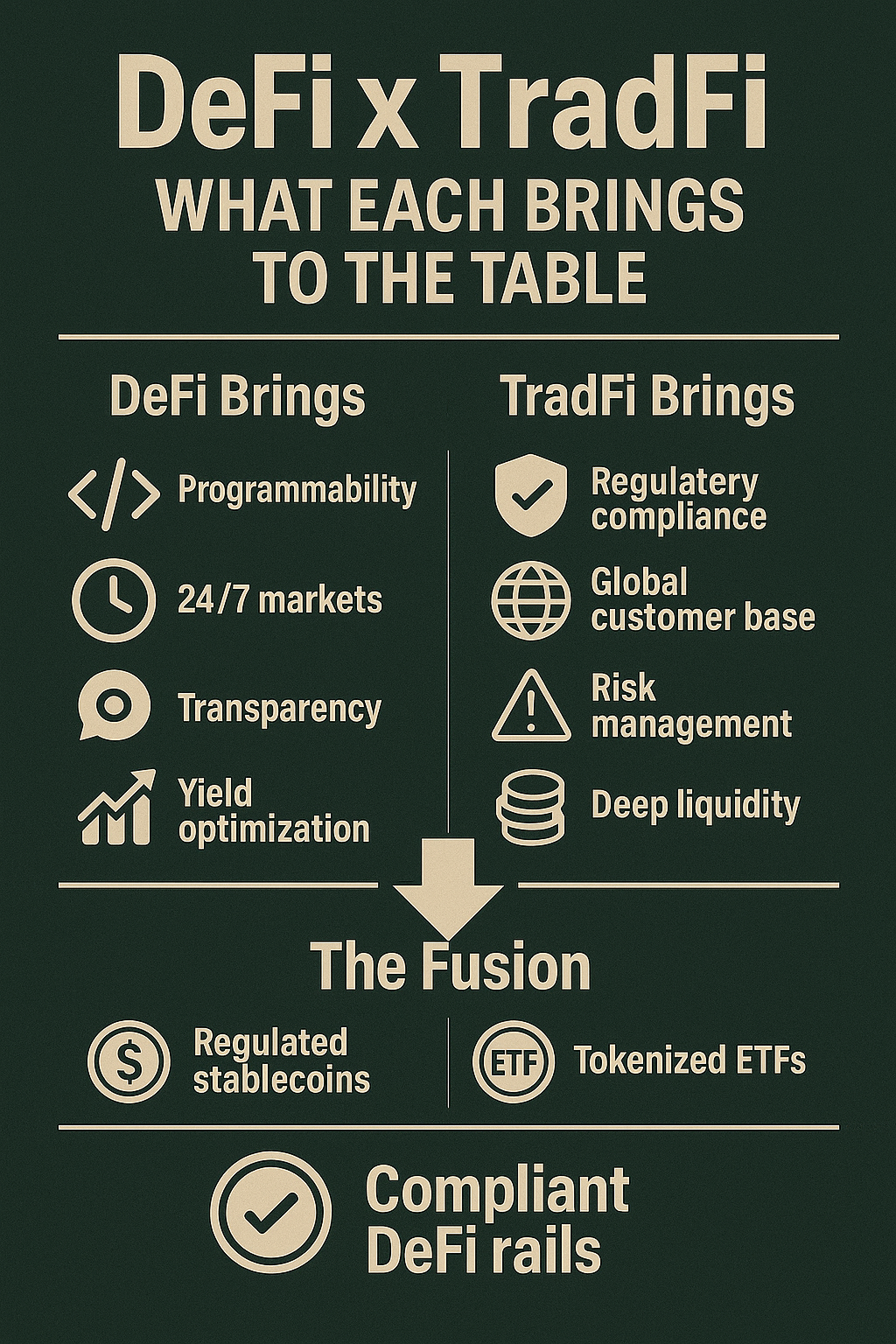

While the world debates the next rate hike and watches AI stocks soar, something far more structural is happening under the radar: the crypto-industrial complex is quietly merging with traditional finance. From megabanks eyeing stablecoins to global regulators drawing the rules of a new digital financial order, last week made one thing crystal clear : crypto isn’t dying. It’s maturing. And fast.

Here’s your breakdown of the biggest tectonic shifts that are reshaping the future of money, power, and sovereignty.

Institutional Power Plays: Wall Street Wants In

Once the loudest crypto critics, America’s largest banks are now exploring their own joint stablecoin venture : a unified, regulated digital dollar to rival the likes of Tether and USDC. JPMorgan, Wells Fargo, Citigroup, and BofA are in talks to mint a co-owned token, contingent on legislation like the GENIUS Act passing through Congress.

Why now? Because regulators are finally setting the rules, and the banks smell a trillion-dollar opportunity. This isn’t a pivot. It’s a power move.

Meanwhile, Jamie Dimon " crypto’s perennial skeptic " just waved the white flag. JPMorgan will now let clients buy Bitcoin. Not because Jamie likes it, but because his customers do.

“I don’t think you should smoke. But I defend your right to smoke,” Dimon said.

Translation: Bitcoin is inevitable, and we’d rather profit than protest.

For DeFi readers? This is the institutional olive branch. Expect liquidity to surge and ETF-based access to onboard boomers and bankers alike. But beware: the rails may look decentralized, but the hands at the switch are getting very TradFi.

Global Regulatory Momentum: Clarity is Coming

Hong Kong just leapfrogged the West with a new licensing regime for stablecoins. If you want to issue a fiat-backed token, you’ll need full reserves, transparency, and an HKMA stamp of approval. Sounds heavy? Sure. But it’s also the green light builders have been waiting for.

Contrast that with the U.S., where a real breakthrough finally happened: the GENIUS Act - a bipartisan stablecoin bill - advanced in the Senate. For the first time, Washington is signaling that it’s ready to regulate, not obliterate, the digital dollar.

What this means:

- Stablecoins are going mainstream.

- Institutions want in, and now have a framework to play.

- The U.S., Hong Kong, and the EU are drawing lines in the sand. And the game is global.

For crypto founders and fintech builders: the fog of regulation is lifting. Build fast, but build clean. The regulators are watching, but at least they’re showing up.

Crypto’s Courtroom Reckoning: Genesis vs. DCG

In a long overdue reckoning, Genesis has filed to claw back $3.2 billion from its parent company DCG. The allegation? Fraud, self-dealing, and prioritizing insiders over users. The message? No one’s too big for accountability - not even Barry Silbert.

DCG, the powerhouse behind Grayscale and CoinDesk, now faces a legal battle that could reshape how crypto conglomerates operate. Expect depositors to fight hard, and courts to dig deep.

For market participants? The lawsuit may trigger forced asset sales, particularly from Grayscale. That could mean volatility, but also long-term cleansing of the ecosystem. We’re watching the industry police itself. And that’s exactly what needs to happen.

Final Thoughts: Crypto's Crossing the Rubicon

This week wasn’t about coins pumping or protocols launching. It was about systems shifting:

- Banks are building.

- Regulators are formalizing.

- Presidents are tokenizing.

- And the courts are demanding accountability.

Crypto is growing up - and the stakes are only getting bigger. For those building at the edges of finance, this is your moment. For those spectating from Wall Street, the gates are open. And for everyone else? The old financial order is making room - not out of kindness, but necessity.

Stay sharp. Stay sovereign. Stay building.