Beyond the Peg: Tether's Billion-Dollar Empire

The most traded digital asset on earth isn’t Bitcoin. It’s not even Ethereum. It’s a token that flies under the radar of most headlines but serves as the invisible engine of the crypto economy: Tether (USDT).

The most traded digital asset on earth isn’t Bitcoin. It’s not even Ethereum. It’s a token that flies under the radar of most headlines but serves as the invisible engine of the crypto economy: Tether (USDT).

With $150 billion in circulation, Tether isn’t just a stablecoin. It’s the dollar of the internet. But beyond the peg lies an ecosystem of market infrastructure, high finance, and quiet profitability that makes Wall Street blush.

So what exactly is Tether? How does it work? And is it built to last?

What Is Tether, Really?

Tether is a stablecoin: a digital token that aims to equal $1 at all times. But it doesn’t get that value from speculation. It gets it from reserves:

"Every USDT is backed 1:1 by assets held by the company."

That’s not just marketing: it’s policy. And so far, it’s worked.

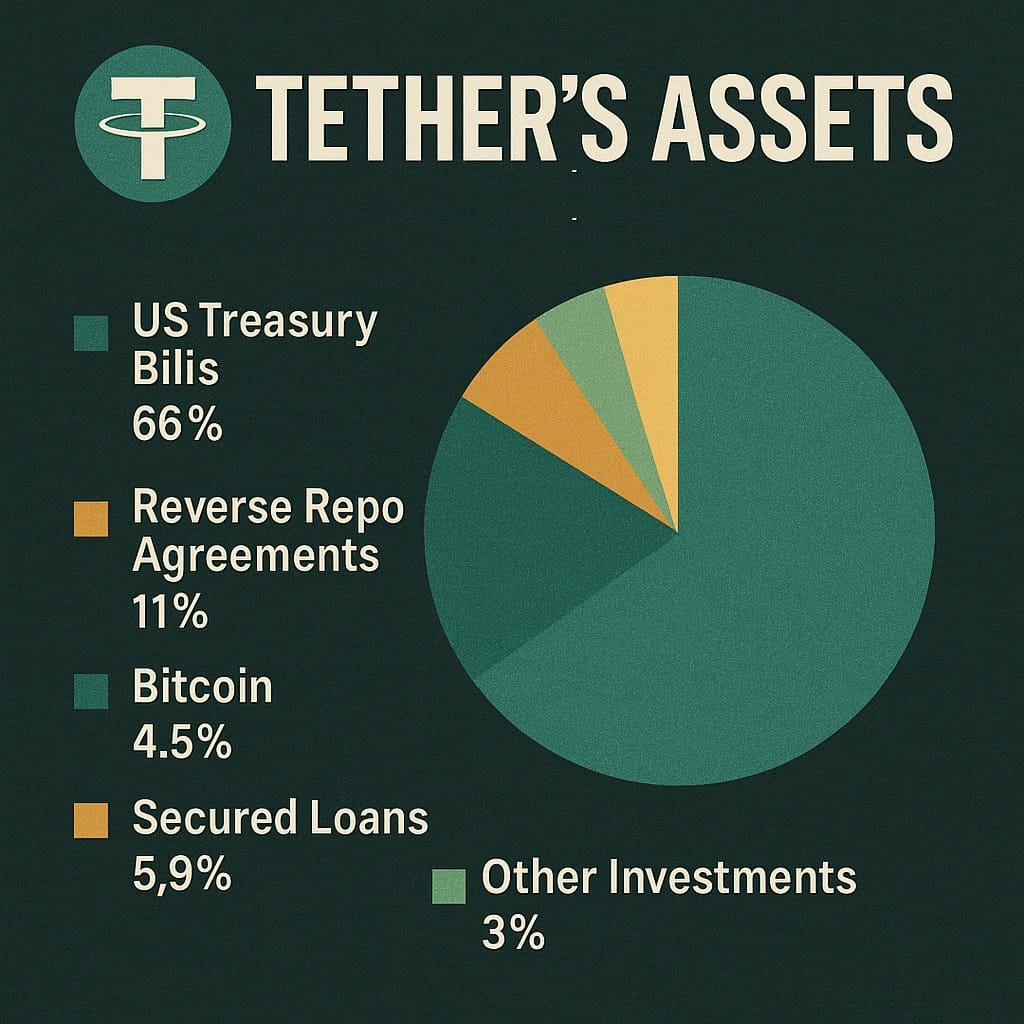

What Backs the Billions?

As of March 2025, Tether’s $149 billion in issued tokens are backed by:

- 66% U.S. Treasury Bills

- 11% Reverse Repos

- 5% Bitcoin

- 4.5% Gold

- 6% Secured Loans

- 3% Other Investments

The takeaway? USDT is largely backed by short-term U.S. government debt, making it not just stable, but yield-generating. And unlike banks, Tether doesn’t lend out your money. It parks it, earns on it, and publishes quarterly reports.

It even holds a $5.5 billion equity cushion, a financial firewall many traditional institutions don’t maintain.

A Profitable Powerhouse

Here’s where it gets interesting. Tether doesn’t charge you to use USDT. But it earns billions by holding reserves in interest-bearing assets.

In Q1 2025 alone, Tether earned $852 million in net income. That’s more than many public companies.

And yes, it pays dividends to its private shareholders. In the same quarter, it distributed $2.35 billion. That’s the kind of performance hedge funds dream of.

Who Uses It? Everyone

Tether is embedded in crypto’s foundation. Traders use it on exchanges. Market makers use it for liquidity. Emerging markets use it as a digital dollar alternative.

From Istanbul to Lagos to Buenos Aires, USDT is how people protect their savings and settle cross-border trades.

Even U.S. exchanges use it under the hood to power trades. If you’ve touched crypto, chances are you’ve touched Tether.

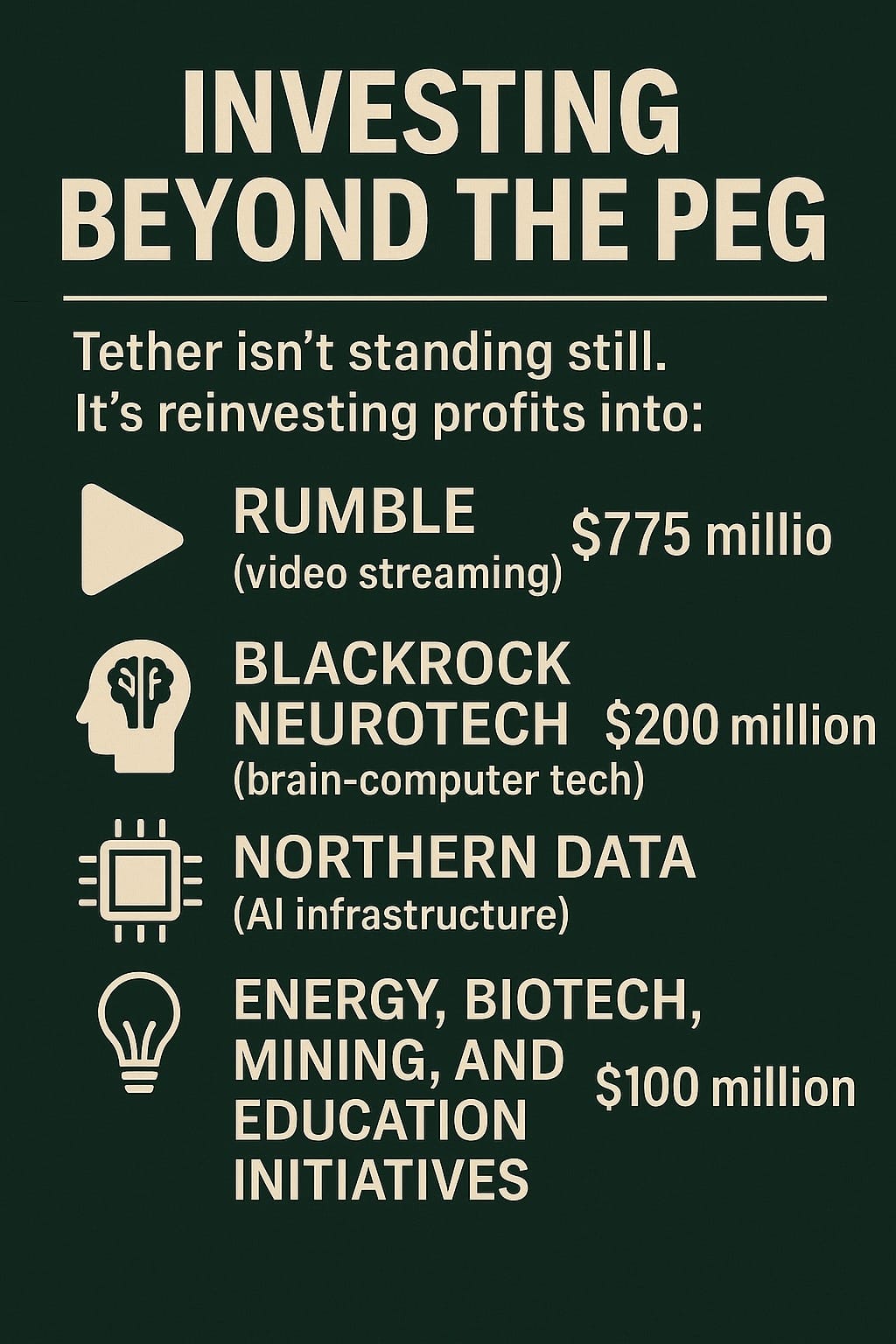

Investing Beyond the Peg

Tether isn’t standing still. It’s reinvesting profits into:

- Rumble: $775 million invested in video streaming, including a $525M tender offer

- Blackrock Neurotech: $200 million in brain-computer interface research

- Northern Data Group: Majority stake acquisition and financing into AI infrastructure

- Bitdeer: $100 million stake in Bitcoin mining, with $50M options

- Other sectors: Energy, biotech, mining, and education initiatives

This adds up to $1.5 billion+ in disclosed strategic investments, building out a high-growth, high-impact tech portfolio.

It’s a vision that looks less like a stablecoin startup and more like a sovereign wealth fund for crypto.

So, Is Tether Safe?

Tether has faced scrutiny and passed stress tests. In May 2022, it redeemed over $10 billion in 48 hours during a market panic. It didn’t flinch.

The case for confidence:

- Full asset backing

- $5B+ equity buffer

- Quarterly attestations by BDO

- Proven resilience in volatility

The caution flags:

- No full audit yet

- Some exposure to volatile assets

- Private ownership structure

But here’s the truth: in the real world, no system is perfect. What matters is track record. And Tether’s is one of scale, stability, and unmatched adoption.

Final Word:

Tether isn’t just a stablecoin. It’s the plumbing of crypto, the reserve currency of a new financial frontier.

Use it wisely. Understand what backs it. And recognize the remarkable financial machine quietly humming behind the blockchain.

Because for now? It works. Exceptionally well.