AI Is Already Running the Markets: Why Wall Street's Smartest Capital Now Comes with a Neural Net

Let’s stop pretending. Your favorite hedge fund manager? Probably shadowed by an AI system. That trading desk at your broker? Being optimized by neural networks. And your robo-advisor? It’s not just rebalancing your portfolio: it’s learning how to beat human bias at scale.

From Wall Street to FX desks to Main Street mobile apps, artificial intelligence has already cracked the code of modern market structure. Not tomorrow. Now.

Quant Gods and Neural Nets

At the top of the food chain: hedge funds like Bridgewater, Two Sigma, and Point72 are all-in on AI. Bridgewater’s latest $2B strategy doesn’t just use AI: it lets it call the shots. JPMorgan has LOXM, an execution algorithm trained on billions of trades. RBC’s Aiden uses reinforcement learning to outmaneuver the market in real time. XTX Markets? They’re deploying 10,000+ A100 GPUs to price over 50,000 assets and trade $250 billion a day. That’s not an edge: it’s a fortress.

Meanwhile, banks and asset managers like BlackRock are optimizing portfolios with AI-driven systems like Aladdin. Execution, allocation, sentiment mining: it’s all machine-augmented now. If you’re not coding signals or training models, you’re the one being traded against.

Robo for the Rest of Us

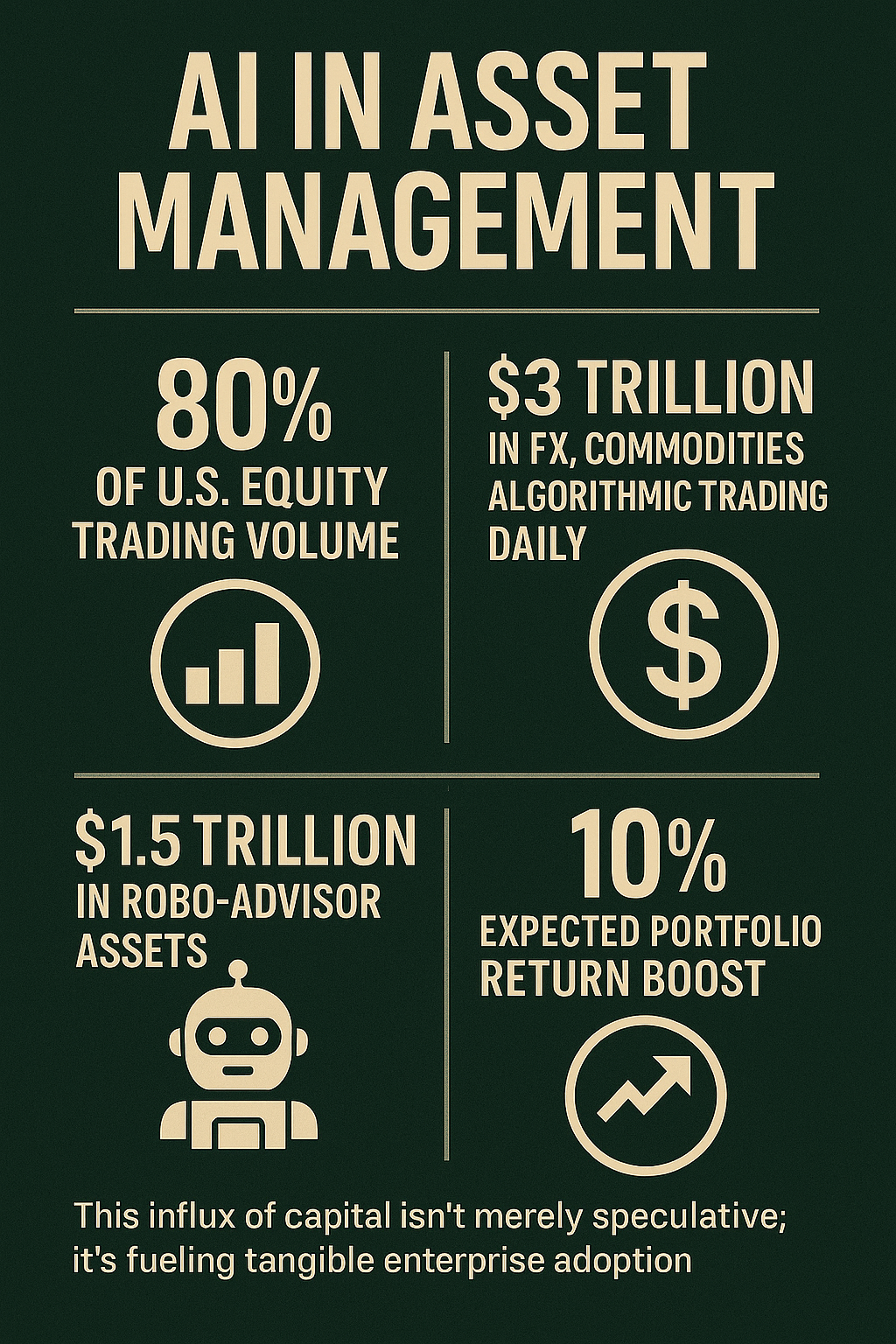

Think AI’s just a quant club toy? Think again. Wealthfront and Betterment manage over $1.6 trillion using AI-based portfolio logic. Robo-advisory AUM is expected to cross $2.5 trillion by 2026. Robinhood just dropped “Cortex,” its new AI trading assistant, with real-time summaries, trade suggestions, and news analysis.

The AI toolkit is now in everyone’s pocket. Portfolio rebalancing, tax-loss harvesting, stock screening: all turbocharged by algorithms. Platforms like Trade Ideas are giving retail traders machine learning scanners once reserved for prop desks.

Still think this is a phase? AI-powered ETFs are already outperforming legacy funds. They turn over their holdings 11 to 12 times a year on average—versus once or twice for traditional actively managed funds. These aren’t just funds they’re live codebases in constant motion.

Liquidity Flows Where the Code Goes

AI now drives 70 to 80% of U.S. equity trading volume. In spot FX, it’s roughly 75%. On the commodity side, AI and algorithmic traders dominate systematic CTAs. The global AI-trading tech market hit $18 billion in 2023, and it’s projected to reach $50 billion by 2033.

In equities, AI funds digest the Fed’s minutes in seconds. A 2023 study found that market reactions within 15 seconds of Fed releases now accurately reflect the final price move/proof that NLP models are beating humans to the trade.

And these bots aren’t guessing. They're adapting. They're learning. And they’re making markets more efficient: tightening spreads, digesting risk, and reducing slippage. Faster trades. Smarter flows. Better fills.

The Hidden Edge

Beyond predictions, AI is running risk models, optimizing order books, flagging compliance anomalies. It sees correlations before humans can chart them. It parses tone in earnings calls, sentiment on social, foot traffic from satellites. It trades the edge between signal and noise.

Want to front-run the consumer cycle? AI’s watching credit card data and unemployment searches. Want to hedge climate exposure? It’s scanning heat maps and crop forecasts. This isn’t just math: it’s cognition.

Regulators Are Watching (But Not Slowing It Down)

Yes, there are black-box risks. Yes, regulators are starting to ask for transparency. The EU is pushing explainability. The SEC wants AI conflict disclosures. Flash crash scenarios are on the radar.

But here’s the thing: nobody wants to kill the golden goose. AI is making markets cheaper to access and harder to game.

It's not just a tool for the elite: it's the infrastructure of the next economy.

Stop Fighting the Future

AI isn’t coming for markets. It’s already taken over. Quietly. Systematically. And for the most part: productively.

The smart money isn’t debating ethics while falling behind. It’s coding, testing, deploying. The winners of the next decade won’t just understand macro: they’ll understand machine.

If you’re still waiting for the bell to ring on this trend, too late. The machines are already in. The question is: are you riding the rails, or getting run over by them?

Welcome to the era of autonomous capital. Broke Warren is here to track it, decode it, and show you where the edge is hiding.