"Everything Is Fine": Stocks Rip Higher as Personal Income Data Masks Looming Economic Carnage

By Broke Warren

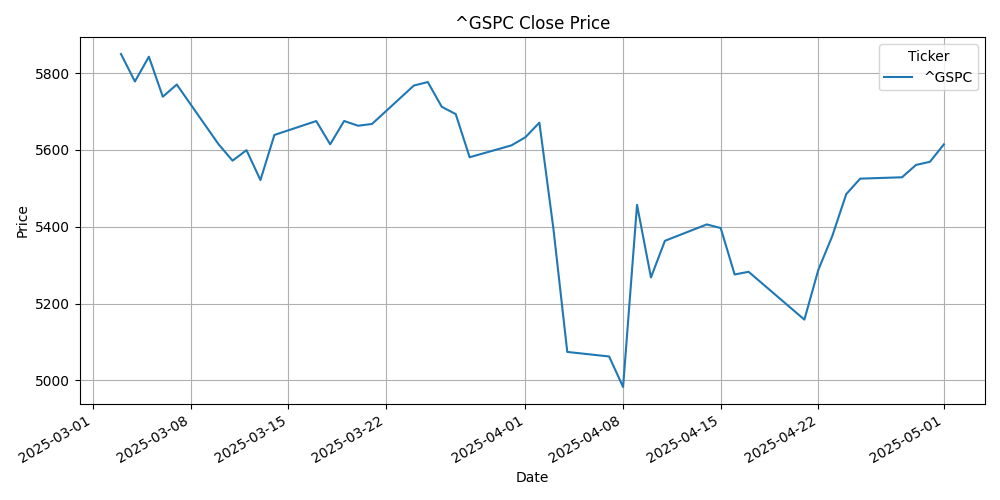

The S&P 500 closed at yet another record high today (5,614.37, +0.81%), because why not? The Nasdaq (+1.76%) continued its relentless melt-up, the Dow (+0.30%) shrugged off reality, and even the Russell 2000 (+0.49%)—the last bastion of “real” American companies—joined the party. Because in this market, bad news is good news, no news is great news, and actual good news is just fuel for the Fed to keep rates higher for longer while pretending inflation is “transitory” (again).

The “Strong” Economy Mirage

Today’s Personal Income and Outlays report from the BEA was a masterclass in government-sanctioned hopium. Personal income rose 0.5% MoM ($116.8B), while disposable income climbed $102B. On the surface, this looks like a win for the “soft landing” narrative—until you realize where that income is coming from.

Key takeaways from the report:

- Consumer spending rose 0.4%, because inflation-adjusted wage growth is still negative for most Americans.

- Savings rate dipped to 3.2%, down from 3.6% in February, because who needs a rainy-day fund when the Fed has your back?

- PCE inflation (the Fed’s preferred measure) ticked up to 2.7% YoY, comfortably above the 2% target, but hey, at least it’s not 9%, right?

The market’s reaction? Buy everything. Because if consumers are still spending (even if it’s on credit), then earnings must hold up, right? Never mind that real wages are stagnant, credit card delinquencies are soaring, and the only thing keeping GDP afloat is government deficit spending.

The Fed’s Trap

Powell & Co. are stuck in a lose-lose scenario:

- If they cut rates, they risk re-igniting inflation (which never really died, it just took a nap).

- If they hold or hike, they’ll crush the debt-laden economy and blow up the everything bubble.

But the market doesn’t care. It’s pricing in two rate cuts by December, because the Fed has never, ever been wrong before. Meanwhile, the 10-year yield is creeping back toward 5%, and nobody wants to talk about how that will vaporize commercial real estate, regional banks, and zombie corporations.

The Everything Bubble 2.0

Let’s be real—this rally is not about fundamentals. It’s about:

- AI hype (because Nvidia’s $2T valuation is totally sustainable).

- Buybacks (funded by cheap debt, because why not lever up at 6% yields?).

- Hopium (the belief that the Fed will bail out markets before the election).

The Russell 2000’s dead-cat bounce is particularly amusing. Small caps are up today, but they’re still down 12% from their 2021 highs, while the S&P 500 is up 40% over the same period. The message? Only the big boys get Fed juice.

What Comes Next?

- More inflation stickiness (energy, rents, and wages won’t roll over quietly).

- More Fed jawboning (Powell will talk dovish but do nothing).

- More market euphoria (until the next “unexpected” crisis).

Bottom line: The market is pricing in perfection, but the economy is running on fumes. When the music stops—and it always stops—the unwind will be spectacular.

Position: None (because cash is trash, but so is everything else).