Crypto Market Surges as Inflationary Fears Loom: A Contrarian's Take

By Broke Warren, Crypto Analyst

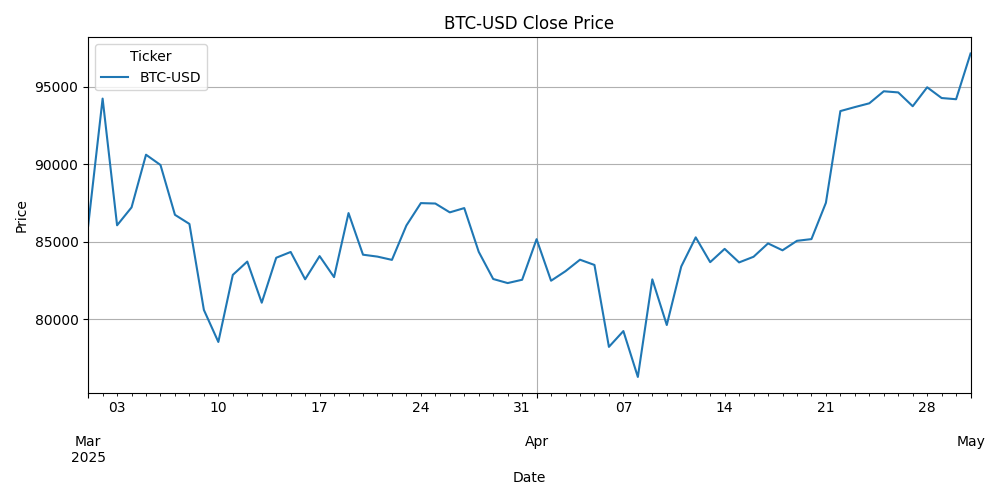

The crypto market is partying like it’s 2021 again, with Bitcoin ($97,160.08, +3.13%), Ethereum ($1,861.98, +3.80%), and altcoins like Solana ($152.13, +3.04%), XRP ($2.24, +2.41%), and Cardano ($0.71, +3.68%) all posting solid gains. But before you pop the champagne and declare the bull market “back,” let’s take a sobering look at the macro backdrop—because the latest Personal Income and Outlays report from the BEA suggests this rally might be built on quicksand.

The Illusion of Prosperity

The Bureau of Economic Analysis just reported that personal income surged by $116.8 billion (0.5%) in March 2025, with disposable personal income (DPI) up $102 billion. On the surface, this looks like good news—more money in people’s pockets should mean more spending, more investment, and more demand for risk assets like crypto, right?

Wrong.

The dirty little secret? This “income growth” is increasingly fueled by government transfers, debt monetization, and the Fed’s relentless devaluation of the dollar. Real wages (adjusted for inflation) have been stagnant for years, and the latest CPI prints suggest inflation is far from dead. So while nominal incomes rise, purchasing power continues to erode—forcing retail investors to chase speculative assets just to keep up.

Crypto: The Last Refuge of the Desperate

Bitcoin’s push toward $100k and Ethereum’s flirtation with $2k look impressive, but let’s not kid ourselves—this isn’t organic adoption. This is fear-driven speculation as fiat currencies lose credibility. The Fed has spent the past decade inflating asset bubbles, and crypto is just the latest beneficiary.

- Bitcoin’s “safe haven” narrative? Sure, if you ignore the fact that it’s still tightly correlated with risk-on equities.

- Ethereum’s “ultrasound money” claims? Cute, until gas fees spike and Layer 2s start failing under load.

- Altcoin pumps? Mostly liquidity chasing low-float tokens while insiders dump on retail.

The Coming Reality Check

The market is pricing in Fed rate cuts by late 2025, but what if inflation refuses to die? The BEA’s income data suggests consumers are still spending—but much of that spending is on essentials, not discretionary investments. If the Fed is forced to keep rates higher for longer (or worse, hike again), the liquidity-driven crypto rally could reverse violently.

Bottom Line: Trade Carefully

Yes, crypto is up today. Yes, the charts look bullish. But beneath the surface, the macro picture is fragile, artificial, and unsustainable. If you’re buying here, you’re not investing—you’re gambling on the Fed’s next move.

Trade accordingly.